For more information on supports for businesses impacted by COVID-19 please visit Gov.ie

The Temporary Wage Subsidy Scheme (TWSS) was introduced on 24 March 2020 and was passed into law under Part 7 of the Emergency Measures in the Public Interest (Covid-19) Act 2020, which was enacted on 27 March. The purpose of the TWSS is to provide income support to employees, where their employer was negatively impacted by the Covid-19 virus, in the hope that employers would retain staff during the pandemic and maintain a link with the staff. In addition, by operating the scheme it was hoped, the Department of Employment Affairs and Social Protection (DEASP) would have a reduced burden in operating other Covid-19 related payments. It was anticipated the scheme would run for a period on twelve weeks, however there is an option for this period to be extended by the Minister.

Summary of the Scheme:

The scheme has been run in two phases, the transitional phase runs from 26 March until 4 May and provides a refund to employers up to €410 for each qualifying employee. Where the refund provided exceeds the amount due for an employee, the excess is refundable to Revenue. This excess will be offset against refunds due in phase two.

For payroll submissions after 16 April, the scheme was extended to higher paid employees as follows: where the employee earned less than €586 per week a refund to employers up to €410 for each qualifying employee. For employees earning between €586 and €960, the subsidy will be up to €350 for each qualifying employee.

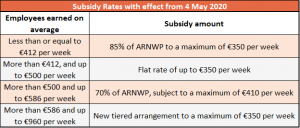

Phase 2, the operational phase, commences from 04 May and provides for payment of a subsidy based on each individual’s Average Revenue Net Weekly Pay (ARNWP), subject to the maximum weekly tax-free amounts. The previous weekly average take home pay is based on an employee’s pay in January and February 2020.

The level of subsidy is set out in the following table:

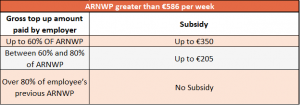

Subsidy is subject to ‘tapering’. That means the level of subsidy is calculated by reference to the amount of any additional (‘top up’) payments made by the employer and its effect on the weekly average take home. Tapering or restriction of the subsidy shall apply to all cases, except those where Average Revenue Net Weekly Pay (ARNWP) does not exceed €412 where the additional gross pay paid by the employer and reported on their payroll submission, plus the wage subsidy amount, exceeds the employee’s ARNWP.

In many cases the payment of the Temporary Wage Subsidy and any additional income paid by the employer will result in the refund of Income Tax or USC already paid by the employee. Any Income Tax and USC refunds that arise as a result of the application of tax credits and rate bands can be repaid by the employer and Revenue will also refund this amount to the employer.

Income tax, USC, LPT, if applicable, and PRSI are not deducted from the Temporary Wage Subsidy. However, the Subsidy will be liable to Income Tax and USC on review at the end of the year. Employee PRSI will not apply to the subsidy or any top up payment by the employer.

Employers PRSI will not apply to the subsidy and will be reduced from 10.95% to 0.5% on the top up payment.

Qualifying Conditions:

To qualify for the Scheme, employers must:

- be experiencing significant negative economic disruption due to Covid-19;

- be able to demonstrate, to the satisfaction of Revenue, a minimum of a 25% decline in turnover;

- be unable to pay normal wages and normal outgoings fully, and

- retain their employees on the payroll.

The Scheme is confined to employees who were on the employer’s payroll as at 29 February 2020, and for whom a payroll submission was made to Revenue in the period from 1 February 2020 to 31 March 2020.

After the Scheme has expired, the names of all employers involved will be published on Revenue’s website.

Registering for the Temporary Wage Subsidy Scheme:

Any employer, already registered with Revenue for the purposes of the Employer COVID-19 Refund Scheme, is not required to take any further action to avail of the current, or the revised, Scheme. The employer may continue to make payroll submissions on the same basis as they were doing previously and €410 will be refunded in respect of each eligible employee per week.

Employers, or their agents, wishing to register for the Scheme can apply to Revenue by carrying out the following steps:

- Log on to ROS MyEnquiries, click ‘Add A New Enquiry’ and select the category ‘Covid-19: Temporary Wage Subsidy’;

- Read the ‘Covid-19: Temporary Wage Subsidy Self-Declaration’ and press the ‘Submit’ button;

- Revenue will issue a confirmation via MyEnquiries and the employer can immediately operate the scheme;

- Ensure bank account details on Revenue record are correct. These can be checked in ROS and in ‘Manage bank accounts’, Manage EFT’, by entering the details of the refund bank account that the refund is to be made to.

Further information relating to the scheme is available from Revenue’s website at the following link:

or contact a member of our tax team at 046 929 35 37 or info@woodspartners.ie.